Do you want to know how to edit tags in Shopify? You…

How To Open A Stripe Account As A Non-US Resident (Guide)

The world is becoming increasingly interconnected, with online businesses operating across borders and people working remotely from the comfort of their homes anywhere with an internet connection.

This globalization has propelled the rise of online businesses and e-commerce stores, creating a demand for seamless international payment processing solutions or gateways.

Stripe payment processor has emerged as a leading platform for online payments and e-commerce business, but navigating its requirements as a non-US resident can be discouraging.

In the guide, I will walk you through opening a Stripe account using Wise for non-US residents.

Many aspiring drop shippers ask if they can open a Stripe account for non-US Residents for their e-commerce business or get a reliable payment gateway.

The short answer is yes. If you are not US-based, you can open a Stripe account, and other payment gateways work for non-US residents.

However, it is essential to remember that each payment gateway might have different requirements for setting up an account on its platform, so read through its terms and conditions before signing up.

Additionally, a few steps need to be taken, such as obtaining a merchant ID and setting up an international processing account. Once your account is set up, you can accept customers’ online payments worldwide.

Stripe is one of the best, if not the most popular, payment gateways for online transactions. It offers a seamless experience for businesses and consumers.

However, Stripe only supports some countries, which can be problematic for entrepreneurs or business owners looking to expand their reach.

But don’t worry because we’re here to give you some answers and provide solutions to your Stripe-related questions.

Stripe is a technology company that provides an online payment platform for businesses of all sizes.

It’s known for its simplicity, security, and versatility, making it a top choice for businesses that need to accept payments from customers worldwide.

From small startups to large enterprises, Stripe has something to offer everyone.

What is Wise?

Table of Contents

Before discussing the specifics of opening a Stripe account as a non-US resident, it’s vital to understand why Wise is a valuable tool for non-US residents running online businesses.

Wise is a financial technology company that offers international money transfer and multi-currency account services.

It provides a convenient and cost-effective way for non-US residents to obtain US bank account details, which can be used to satisfy Stripe’s requirements.

Wise isn’t a traditional bank, but it offers many of the same services, including the ability to hold and manage money in different currencies.

This is particularly helpful for international businesses, as it allows them to receive payments in their customers’ local currencies and avoid hefty conversion fees.

Understanding the Challenges

Stripe’s payment gateway or processor has specific requirements for account creation on its platform, which can pose challenges for non-US residents who want to experience seamless payment transactions for their businesses.

These requirements, set by Stripe, are intentionally in place to help individuals comply with financial regulations, prevent fraud, and ensure the security of every transaction.

Let’s take a closer look at some of these challenges:

- US Business Entity: Stripe requires a US-registered business entity, such as an LLC or a corporation. This can be a significant hurdle for non-US residents who may not be familiar with US business registration processes. Forming a US entity involves legal and administrative steps that can be time-consuming and complex.

- US Bank Account: You’ll need a US bank account to receive payouts from Stripe. This is often a significant obstacle for non-US residents, as many US banks require a Social Security number or a US address to open an account. Even when non-residents can open accounts, they may face higher fees or restrictions.

- US Physical Address: A valid US address is necessary for account verification. This can be challenging for non-US residents who may not have a physical presence in the US. While virtual addresses can sometimes be used, Stripe may require proof of a physical business location.

- EIN or Tax ID: An Employer Identification Number (EIN) or equivalent tax ID is essential. The IRS uses this unique identification number for tax purposes. Obtaining an EIN as a non-US resident requires navigating IRS procedures and providing the necessary documentation.

- Working Website: Stripe requires a website that showcases the business’s offerings (products or services). This website should be functional, provide a seamless checkout experience for customers, and accurately represent the business.

These requirements can be challenging to meet for those residing outside the US. However, services like Wise can help bridge the gap and make it possible to open a Stripe account.

What Countries Are Supported by Stripe?

Currently, Stripe supports businesses in more than 40 countries, including the United States, the United Kingdom, Canada, Australia, and many European countries.

Visit the Stripe website for a complete list of supported countries. Stripe is a secure and reliable payment processing platform that allows you to accept customer payments effortlessly. It supports major credit cards and ACH (Automated Clearing House).

With Stripe’s API, you can use recurring billing and subscription management features.

Plus, its dashboard provides real-time analytics so that you can continuously optimize your business operations.

Stripe also offers fraud prevention, manual review queues, and the ability to accept customer payments in over 135 currencies.

Stripe is a safe, reliable payment solution that allows you to manage and monitor your transactions easily. It also seamlessly integrates with Dropshippingit’s software to provide an even richer experience for your customers.

Can I Use A Stripe Account in an Unsupported Country?

The short answer is yes, you can use Stripe in an unsupported country. However, it would help if you found a workaround.

The best solution is to use a virtual address service to receive payments in a supported country and transfer them to your local bank account.

This is called a “proxy solution,” many businesses use it in unsupported countries.

Can you open a stripe for non-residents?

Unfortunately, Stripe is not currently available for businesses outside the US, but this guide will teach you how to get a Stripe account approved even if you don’t live in the US.

If you’re a non-US resident, you must look for something other than a Stripe alternative payment processor.

It’s a common problem for online businesses – you want to accept payments from customers worldwide, but setting up the infrastructure to do so can take time and effort.

If you’re a non-US resident, finding a payment processor that works for you may be challenging.

Stripe payment gateway is a popular processor for US businesses; what about those who don’t live in the States?

How can they get Stripe for non-residents to work for them?

A lot has changed. As you all know, Stripe has upped their game; when they read these tactics online, they upgraded their system, hence the recent cries of limitation accounts, especially those who successfully applied the method I shared above.

This post provides quick setup documentation for international sellers who use Shopify for their drop shipping business but find it difficult to run the business from their respective countries due to payment processor gateway challenges.

So, I will take you through how to set up a Shopify store and how you will get your Shopify payment gateway done correctly.

Suppose you are an active member of any dropshipping business Facebook group.

In that case, you know how many store owners post about their store being on hold or limited by payment processors like PayPal, Stripe, and even Shopify payment themselves.

I hope you are getting something ready to learn how to make Shopify Payments available for your customers.

It happens more frequently if you are dropshipping and term it a high-risk business due to chargebacks and refund-related issues.

But like you, I wonder why Shopify platforms promote drop shipping and advertise the business model on Facebook, yet they are the first to have your account on hold simultaneously.

Double standards?

To my international sellers, we have to make ends meet. We have no idea how long it will take for this e-commerce giant to start considering integrating payment gateways that favor us from the ones that suck already.

Why is this process vital for your Shopify dropshipping business?

I assume you are not a US citizen or a citizen of any other European country. If you are an international seller, you must adopt this method to receive payment for the profits you accrue through your online product sales.

There are several payment processors available for Shopify, but funny enough.

Almost all of them don’t favor you as an international seller who doesn’t have access to EIN/BIN or SSN to have a US bank account.

So, the ones available on Shopify will force your customers to finish the checkout process in a new browser tab instead of completing it while still in your store.

A typical example of a payment method that takes customers out of your store is a 2checkout; it takes them to a new page where they must complete the purchase.

Few customers will finish the conversion if they are redirected to another page regarding online transactions.

We are dealing with sensitive information here; who would trust a payment gateway they’ve never heard of, whereas they are only used to Paypal?

This redirecting hurt a lot of conversions.

When looking for a payment processor as an international seller, you need processors whose rates are similar.

Most sellers lose a lot of cash when it comes to processor rates and currency conversion rates.

It would help if you had a processor offering a reasonable exchange rate.

Unless otherwise specified, your store will use USD as its default currency; hence, the benefits of working with a processor that provides fair currency conversion rates are too great not to sign up with them.

I understand that some international sellers must manage to get their merchant accounts and payment gateway.

Well, and sound, this article is not meant for you since my target is to address those in the business who cannot operate smoothly due to payment gateway issues.

When we were nearing a processors’ solution, Shopify plugged the surprise on us by removing one of its essential plugins, NMI, responsible for a third-party payment gateway that payment processors like Bluesnap heavily on to offer international sellers solutions.

BlueSnap can no longer integrate into the PayPal platform.

So, today, I share the newest, proven method for circumventing dropshipping and getting paid as an international seller on the Shopify platform.

Why Wise is a Good Solution for Non-US Residents

Wise offers several advantages for non-US residents looking to open a Stripe account:

- Virtual US Bank Account Details: Wise provides virtual US bank account details, including routing and account numbers, which you can use to link to your Stripe account. This addresses the challenge of obtaining a US bank account without a Social Security number or a US address.

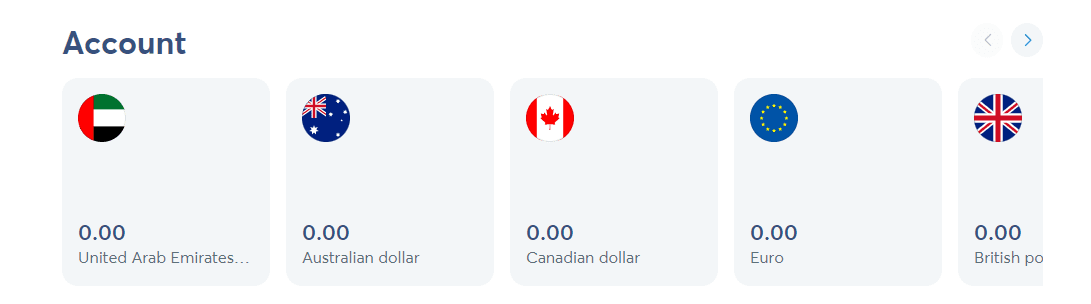

- Multi-Currency Support: Wise allows you to hold and manage funds in multiple currencies, including EUR, GBP, USD, AUD, NZD, SGD, RON, PLN, and CAD. This minimizes currency conversion fees when receiving payouts from Stripe, especially if you have customers in different countries.

- Cost-Effective: Wise generally offers lower fees for international transfers and currency exchange than traditional banks. This can be a significant advantage for businesses that frequently send or receive money across borders.

- Easy Integration with Stripe: Linking your Wise account to Stripe is straightforward. Wise provides clear instructions and support to help you connect your accounts seamlessly.

- Reduced Currency Conversion Fees: You can save money on currency conversion fees by connecting your Wise and Stripe accounts. Stripe does not convert currencies if you receive payments in the same currency as your account. With Wise, you can open one account with multiple currencies and link it to Stripe, allowing you to receive international payments without incurring Stripe’s conversion fees.

- Improved Payment Conversion Rates: Wise has partnered with Stripe to implement a delegated authentication feature that improves payment conversion rates in Europe. This feature allows customers to authenticate purchases within the checkout flow without being redirected to a banking app or entering a one-time passcode.

By addressing non-US residents’ challenges, Wise makes it easier to meet Stripe’s requirements and access its powerful payment processing capabilities.

1: Set-wise account

To start, get a stripe for non-residents if you don’t have an operative Wise Account.

Why do you need a Wise account at this stage?

Besides the reasons we started with, you still need Wise for a few significant other reasons.

As an international Seller, you have a few, if no other, ways to set up a local US account from your respective country of residence without setting foot in the United States.

You can own a virtual US bank account with a verified Wise account because Wise is in an exclusive agreement with Bank of America to enable you to enjoy this freedom.

To open a Stripe account as a non-US resident using Wise, you can follow these steps:

- Create a Wise Multi-Currency Account.

- Link your local bank account to Wise.

- Add the currencies you want to receive and hold money in.

- Add the countries for which you want to get local bank details.

- Use a Euro IBAN or US routing number generated within Wise to open a US or EU currency account in Stripe.

You can use Wise as a local bank account in up to 30+ countries, including the US.

Are you asking yourself why you need a US bank account?

It would be best if you had it to sign up and operate your store with a Stripe account; it’s a mandatory requirement.

When you have a Wise account, it’s effortless to wire cash to your local bank account; Wise allows you to link your bank account.

The second reason this is so great is that you can connect your local bank account to your Wise account.

This means you can transfer your money from your US account to your Wise wallet and then from your Wise wallet to your local bank account.

What makes a Wise account one of the best solutions for international sellers is that besides having the best features, it also has the lowest exchange rates on money transfers from your default store currency, USD, to your local currency.

This is important and very helpful since it allows you to keep the money you made with the slightest difference in exchange.

Using Wise, you can open a personal or business account, but you don’t need a business account if you don’t want to. You can operate with a personal account, and it works just fine.

2: Connect Your Local Bank Account

Once you’ve signed up on Wise, connect your local bank account for an easy cash transfer.

Wise has much to offer for international dropshipping sellers using Aliexpress to Shopify’s business model.

Having a bank account to sign up for a Stripe account is unnecessary, but it’s recommended for smooth operation.

You’ll need a valid bank account to receive payouts.

You can add your bank account to the Stripe account you created by going to Settings > Business Settings in the Stripe Dashboard.

The Stripe payment gateway uses your financial account data to verify your bank account and process online payments.

Stripe may occasionally request verification to confirm that the legal owner’s name and account number match the information you provided on your Stripe account.

3: Setting An LLC Business In The US

It’s time to get your valid business name. Getting an LLC in the US is essential for setting up Shopify Payments, and you will see the advantages of having an LLC.

In this series, LLC is a critical player in creating Stripe for non-residents; hence, one must learn how to make a UK company or set up an LLC.

You need to set up an LLC because you can connect it to your Shopify account and the US bank account to your store’s online Shopify payment section.

To run an honest business, consider registering an LLC. You must do so if you are still considering using Shopify Payments.

I know you are asking yourself now that you have a virtual US bank account, LLC, and Wise, what comes to taxation?

I have used the same method I am sharing with you. You don’t need to pay tax, but you will have to pay tax in your respective country after you’ve earned the payment in your local bank account.

I can advise you on tax, depending on your country of origin.

What I love the most about having an LLC is that it is not limited to the number of stores; you can create as many stores as you want. It acts as an umbrella for many stores.

Your LLC can do business as usual if you have heard of that term abbreviated DBA.

In the same way, you see one LLC presented in different business entities, just like KFC and Taco, which are some leading fast-food restaurants that operate under one LLC umbrella called YUM LLC.

Choose a brandable LLC name that is broad enough to accommodate any business you may have.

How to Create Your LLC

Technology has evolved, and with just a few clicks, you can create your LLC in minutes with the trusted help of Delaware Inc.

You can be sure that you’re in the right hands with their expert team, who will handle everything for you. From registering your LLC to providing additional services such as corporate kits and even registered agents, they ensure the process goes smoothly for you. With Delaware Inc., setting up an LLC has never been more hassle-free – giving you one less thing.

But why Delaware?

Well, incorporating your LLC business is a smart move. As an overseas business owner, you have more to offer; they’ve shared much information about their website and services.

Read more at the link above that I provided you earlier.

Ready?

Head over to their site and fill in your LLC Name (company name) and personal details, and then hit on the GREEN tab, the GREEN PACKAGE for $179.

The last time I checked, it was around $279.

They are offering some discounts, as I was writing this guide.

While still on the page, adding or checking the FEDERAL EIN Services is essential for an extra $95. This is more important and effective than calling the IRS, which no longer works.

How to Get EIN

For international sellers, getting a social security number SSN is impossible.

EIN will act as your SSN; hence, it is essential to complete this stage.

When using Delawareinc, they can get your EIN when you click the” DO NOT HAVE EITHER SSN?ITIN while making your application.

During the sign-up, you must indicate your” Principal Place of Business,” your local business or company address. You can also use your address.

You also need to indicate if you have any job offers in the US in the next 12 months.

If you’ve followed the above, you are done. Confirm the order, and your LLC documents will be sent to you within a week.

Step 4. How To Create Your Stripe Account

This is the easiest part apart from signing up for a Wise account.

To get the account, go to the Stripe website, fill in your details, verify your email, and boom—you’re good to go.

The next step would be to fill in your SSN (Social Security Number). Since you don’t have an SSN, you must key in the four digits of the EIN you received after the application.

At this stage, expect an email from Stripe saying they can’t confirm your identity, don’t worry. Just reply to the email and tell them you are not a US citizen using a registered company’s EIN.

Next, you must verify your ID and LLC company information.

But this will be handled since you have a US company, and Stripe will automatically verify you.

Now that your stripe account is set up and verified, you must set up your business settings.

You need to use the LLC info and address provided by Delawareinc during the application, which I assume you now have the documents sent to you already.

STEP 5: Connecting Your Wise Bank Account To Stripe

While in your Wise account, click the US Balance area to access your US virtual US bank account.

You need to sign up to use Shopify Payments in your store. There is no shortcut to this.

In your Stripe account, you will see a section where you must fill in your banking details. Thus, the spot you need to fill in is your US virtual Bank account. You can get this on your Wise Account under Manage.

It’s simple, and you’re ready to go. It would help if you were all confirmed and ready to use your Stripe payment gateway and have it linked to your Wise account.

STEP 5: Connecting Your Wise Bank Account To Stripe

STEP 5: Connecting Your Wise Bank Account To Stripe

While in your Wise account, click the US Balance area to access your US virtual US bank account.

You need to sign up to use Shopify Payments in your store. There is no shortcut to this.

In your Stripe account, you will see a section where you must fill in your banking details. Thus, the spot you need to fill in is your US virtual Bank account. You can get this on your Wise Account under Manage.

It’s simple, and you’re ready to go. It would help if you were all confirmed and ready to use your Stripe payment gateway and have it linked to your Wise account.

6: Connecting Your Shopify Store

In this last stage, you must connect your Shopify store to the approved Stripe payment account.

Shopify account:

- Head over to the settings tab.

- Click on payment providers or underpayments.

- Choose” stripe “from the menu drop-downs and activate it.

When you are not logged into the stripe account, it can redirect you to log in before activation. Still, if you are logged in, it will be detected automatically and confirmed immediately.

Then, you’ll be all set to start receiving payments with Stripe on your Shopify store!

What are the Benefits of Using a Virtual Address Service with Stripe?

Using a virtual address service with Stripe offers several benefits, including:

- Access to Stripe’s payment platform, even in an unsupported country

- A virtual address in a supported country that you can use to receive payments

- The ability to transfer payments to your local bank account in your local currency

- A secure and reliable solution for businesses that need to accept payments from customers worldwide.

Are there any risks involved in using a virtual address service with Stripe?

As with any financial solution, there are always some risks involved. However, if you choose a reputable virtual address service, you can minimize these risks. Some of the risks to consider include the following:

- Hidden fees or charges from the virtual address service

- Delays in payment processing or transfers

- Security concerns, such as the risk of fraud or theft

Can a non-US citizen open a US Stripe account?

Yes, non-US citizens can open a US Stripe account. To do so, you need to:

- Set up a US LLC company.

- You must have a valid EIN.

- Make sure Stripe operates in your country.

- Have a USA virtual bank account for your business.

- Have a government-issued ID or passport or a valid driver’s license.

- Have a working website or store that shows the details about your business, what you sell, or the services you provide.

If you need a virtual US bank account, you can use WISE. You can also use Wise’s Multi-Currency Account to get a Euro IBAN or US routing number.

Alternative Solutions

While Wise is an excellent solution for non-US residents looking to open a Stripe account, it’s not the only option. If you encounter difficulties with Stripe or Wise, consider these alternative payment processors:

- Payoneer: Payoneer is a global payment platform that offers similar services to Wise, including multi-currency accounts and international money transfers. It can be a viable alternative for receiving payments from Stripe.

- 2Checkout: 2Checkout is another payment gateway that supports international businesses and offers various payment methods. It can be a good option for those who need a more comprehensive payment solution.

- PayPal is a widely recognized and trusted payment platform that allows you to send and receive payments online. While it may have higher fees than Stripe, it can be a simpler option for beginners.

Remember to research and compare different payment processors to find the one that best suits your business needs and requirements.

Important Considerations

- Stripe’s Requirements: Always refer to Stripe’s official website for the most up-to-date requirements and policies. These requirements can change, so it’s essential to stay informed.

- Wise Account Type: While a personal Wise account might work, a Wise Business account is generally recommended for businesses using Stripe. A business account offers features specifically designed for companies, such as invoicing, expense management, and team access.

- VPN Usage: Using a VPN to access Stripe might raise red flags and could potentially lead to account issues. Stripe may view VPN usage as an attempt to mask your location or identity, which could trigger security checks or account suspension.

- Customer Support: If you encounter any difficulties, reach out to Stripe and Wise customer support for assistance. Both companies offer comprehensive support resources and dedicated customer service teams to help you resolve any issues.

Conclusion

If you have tried the above, I hope you are about to launch or use this method for your Shopify business.

Have you learned anything new about Shopify Payments and how to use it? Share your thoughts on the same and your experience.

Opening a Stripe account as a non-US resident can seem daunting, but with the help of Wise, it becomes manageable.

Following this guide and staying informed about the latest requirements, you can successfully set up your Stripe account and accept payments from customers worldwide.

- Set up a Wise account and obtain your US bank account details.

- Register a US company and obtain an EIN.

- Create a Stripe account and provide your business and personal information.

- Link your Wise account to your Stripe account.

By taking a proactive and informed approach, you can overcome the challenges of international payment processing and unlock your business’s full potential with Stripe.

Suppose you’ve used it before.

Contact me if you want a Shopify expert to help design a professional-looking store with hot-selling products.

If you were looking for Shopify Payments alternatives or how to beat Shopify, use it without their knowledge, or dodge the account limitations, there you have it!

I hope you’ve learned how to use Stripe to process payments as a non-US resident.

Start Shopify For Only $1 A Month

Sign Up For A Free Trial and enjoy 3 months of Shopify for $1/month on select plans.

Try Shopify free for 3 days, no credit card is required. By entering your email, you agree to receive marketing emails from Shopify.

Such tremendous help. Thank you so much. I am a newbie and i have the thirst for giving it a shot but had got discouraged on this part. How can I get your assistance in checking out my store and advising me.I am desperate for some raw criticism and assistance too. Kindly advise . Thank you

Awesome. Thank you so much. Living in the Caribbean and wanting to push my shopify store internationally has caused some tremendous headaches. I will be trying your very well explained method this month for my store to bring it to another level to actually help more people and make money. Bless up

Find me on Instagram @dropshippings or Facebook samwel Dollah odhiambo or email samweldollah24@gmail.com